What Does Community Property Mean?

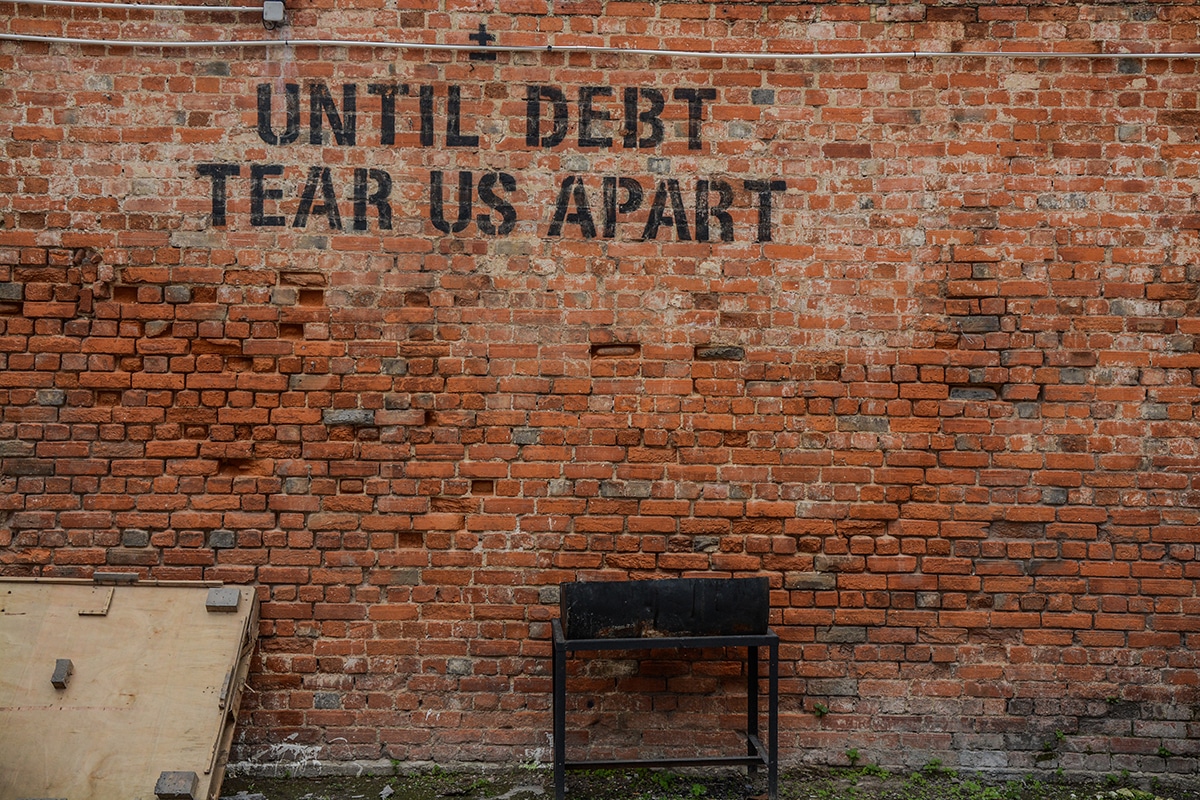

Texas is a community property state. It is presumed that all property owned by married persons at the time of the dissolution of the marriage, whether by death or divorce, is the property of both the husband and the wife. Likewise, any debts incurred during the marriage are presumed to be incurred by both the husband and the wife. Like community property, community debt must be divided during a divorce.

When two people get married, they may bring assets and property with them, and during the course of their marriage, they acquire more. So when the couple decides to divorce, two questions must be asked: What constitutes community property? What is a fair distribution of property? Our law firm represents your best interests in the division of common assets and property from your marriage.

How Community Property Works

In a marriage, a husband and wife own joint property and may retain sole ownership of individual assets and property. The assets and property acquired during the marriage are considered community property. Property gained before the marriage, or during the marriage as gifts or inheritances, are considered separate.

Since Texas is a community property state, in theory, this means that each party is entitled to 50 percent of the property obtained during the marriage as well as responsible for 50 percent of the debt incurred during the marriage. However, a party is entitled to retain his or her “separate property.” While Texas is a community property state, the community property and debt can be divided in a manner that the court deems just and right with respect to the rights of each party and the children of the marriage.

Not Always 50-50

This essentially means that the property and debt do not have to be divided equally between the parties. The court will consider many factors including the size of either spouse’s separate estate and any fault in causing the divorce.

Other factors come into play as well, including earning ability, age differences, fault, health and disabilities, taxes, custody, gifts, and inheritances. Since this gets very complicated, we recommend you seek the advice of one of our knowledgeable attorneys for the division of community property.

Contact Us